In this episode of our podcast series, Q, Head of sales from Orient Futures Singapore covers the main benefits of trade such as access to China’s futures and derivatives markets. Here are some of the key points that were derived from the interview:

Exchange Memberships

Orient Futures Singapore currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and Intercontinental Exchange Singapore (ICE SG). At present, we also serve as an overseas intermediary for Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE). Hence, clients that seek to trade will have connectivity to these exchanges internationally.

Technology

Most importantly, clients can trade Chinese and global markets through a single account, and multi-currencies. This will allow clients to mitigate their portfolio liquidity risk and achieve capital efficiency.

Alternatively, with co-location services, trading clients at the SGX, JPX, CME, and Chinese data centres availing of our High-Frequency Trading (HFT) are given low latency and dedicated access to the Exchange’s trading platform.

Forex Currencies

Some of the forex currencies that can be traded include the Chinese offshore Renminbi/Yuan (CNY), Taiwan Dollar (TWD), India Rupee (INR), Korean Won (KRW), Thailand Baht (THB), Philippines Peso (PHP), Indonesian Rupiah (RP), Singapore dollar (SGD), Israeli New Shekel (ILS), and all G-10 currencies.

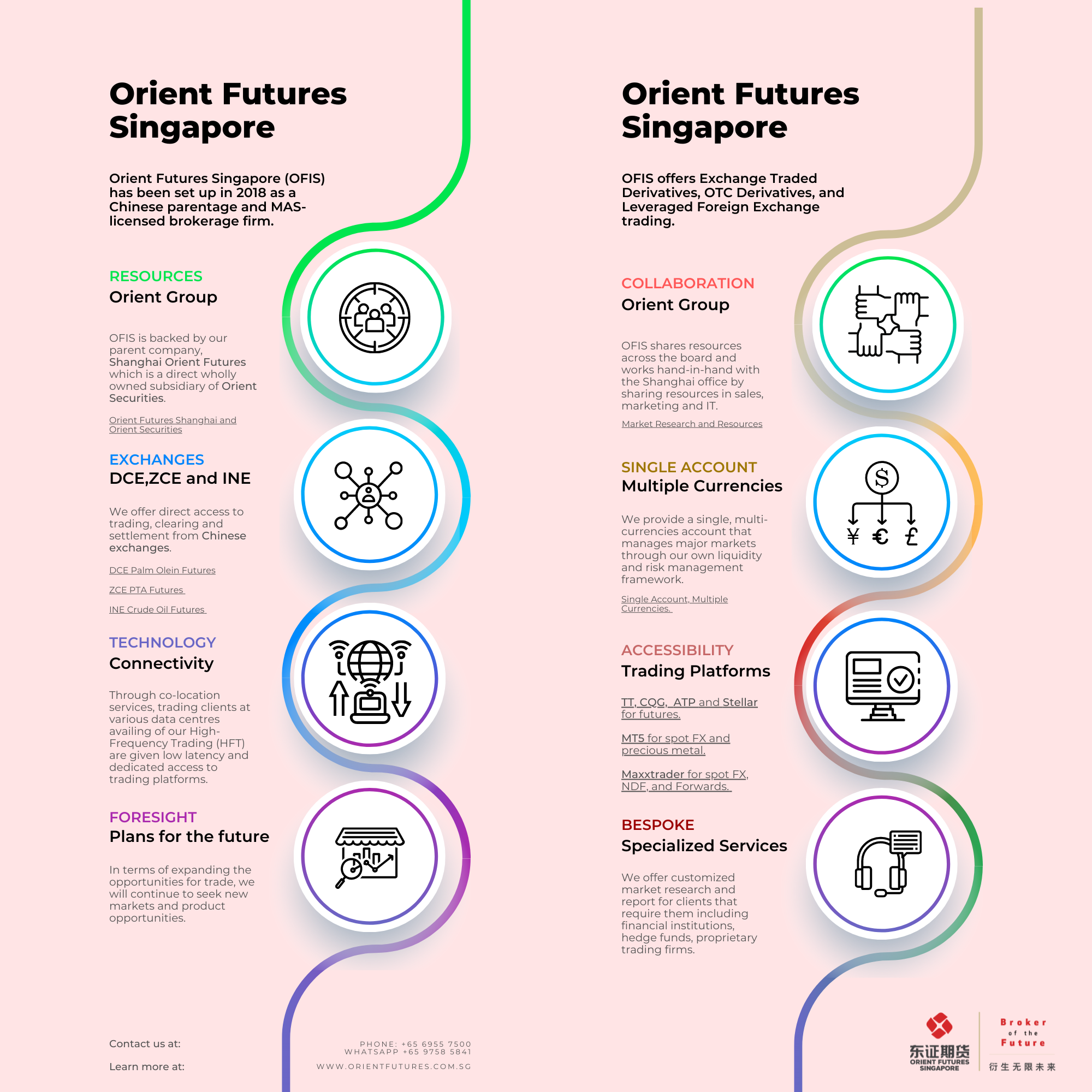

This infographic will cover the rest of the points from the interview:

To access the links and for more information: Download PDF

Click on this link to listen to the podcast.

Additionally, while Orient Futures Singapore provides information regarding the company’s services, here is some additional information regarding the Chinese exchanges and QFII scheme that will help traders understand where and what to trade.

Shanghai International Energy Exchange (INE)

Shanghai International Energy Exchange (INE), a wholly-owned subsidiary of the Shanghai Futures Exchange (SHFE) registered in the China Pilot free trade zone in 2013. The exchange has five international futures and options products.

These products include crude oil, TSR 20, low sulphur fuel oil, bonded copper futures, and crude oil options, which account for more than half of such products on the Chinese mainland.

INE’s deliverables come from all over the world, and one of the most popular futures, TSR 20 involves products from countries, namely China, Thailand, Malaysia, and Indonesia.

Thanks to its physical delivery, industries that include aviation and construction can buy the commodity for consumption and production into end goods

In addition to that, INE is also looking forward and taking steps to launch freight index futures, so international traders can take positions in the shipping market soon.

Dalian Commodity Exchange (DCE)

Dalian commodity exchange is the only futures exchange in Northeast China.

Over the years, DCE has become a major center of futures trading and it is 9th worldwide in terms of the trading volume.

Products that are open to the international trading community include iron ore futures, RBD palm olein futures, and RBD palm oil options.

China is one of the world’s biggest producers of iron ore and is the leading consumer of metal, making trading the commodity in China directly very attractive.

The iron ore futures contract in the DCE allows traders to gain exposure to the commodity for both paper trading and to take physical delivery as well.

With the recent release of the QFI scheme, Orient Futures Singapore will also be incorporating soybean futures into our brokerage services.

Aside from futures that they offer, DCE makes product investment guides available publicly on their website for products with relevant monthly or annual statistics

Hence, traders can look forward to more access to the Chinese market and diversified trading opportunities.

Zhengzhou Commodity Exchange (ZCE)

Zhengzhou Commodity Exchange offers many futures. However, purified terephthalic acid futures or PTA is the only option available to international traders.

PTA is a raw material that can be found in plastic bottles, photographic films, or polyester resins. It is used in many industries and favoured for its lightweight and recyclable qualities.

The future was launched on December 18, 2006, for domestic traders, and later opened in 2018 as part of China’s plans to expand trade and financial services. PTA futures and diverse usage of the material entail a high trade volume. It is the only exchange currently to have such a unique product.

While ZCE specializes in PTA, the exchange also deals with other agricultural products which can be accessed through the QFII scheme as part of the country’s initiative to increase global connectivity.

As of current, the exchange is working on a New Development Concept to coordinate and increase safety.

Other notable products and exchanges

Asia Pacific Exchange

Asia Pacific Exchange (APEX) is a derivatives exchange regulated by the Monetary Authority of Singapore (MAS). It is the third derivatives exchange with the “Approved Exchange” and “Approved Clearing House” licenses in Singapore after Singapore Exchange Derivatives Trading (SGX) and ICE Futures Singapore.

In May this year, APEX launched the Bitcoin Monthly Futures Contract. This is one of the few regulated and cash-settled Bitcoin Monthly Futures contracts offered by a regulated derivatives exchange in the Asia Pacific.

In addition, APEX Gold Perpetual Futures Contract also serves as a tool for our clients’ trading, hedging, and risk management needs.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.